Last week freshman Democratic Congresswoman Alexandria Ocasio-Cortez sparked the latest round of debate about tax policy in the United States. In an interview with Anderson Cooper for 60 Minutes, she embraced the marginal income tax rates of the 1960s—“as high as 60 or 70 percent” in the top bracket—both as a model of fairness and as a way to help finance a Green New Deal.

In fact, the top rate was well above 60 percent not just for the turbulent sixties but for the half century spanning 1932 and 1981, before they were slashed by Ronald Reagan’s tax cuts. (The top rate for 2018, by contrast, is only 37 percent.) Yet Ocasio-Cortez’s figures made headlines as the latest specter of big government, and even Cooper responded by calling her proposal “a radical agenda”—at least “compared to the way politics is done right now.”

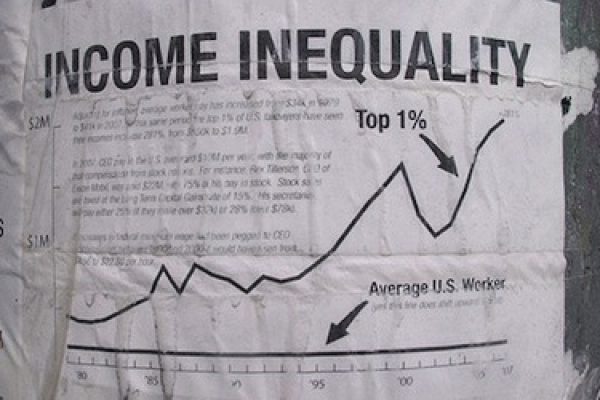

Cooper’s qualification may gesture to the enduring clout of anti-tax lobbies such as Grover Norquist’s Americans for Tax Reform. But realpolitik should not blind us to the ethical and empirical questions. Do high rates in the highest brackets really discourage job creation and economic growth? Can progressive tax policy help to safeguard democracy? These pieces from our archive weigh in on the legacy of trickle-down taxation.

—Matt Lord

Taxation is at the heart of any serious economic growth policy.

Thomas Piketty dismantles received economic wisdom on inequality—including the idea that it is necessary for a rising tide to lift all boats.

Off-shoring, tax havens, and other scourges of globalization.

Emmanuel Saez and David Grusky discuss why taxation, though a blunt instrument, might be the best available solution.

The current tax system in the United States leaves vast differences in wealth and power largely untouched.