This summer’s holiday season in the Mediterranean began with the startling announcement, from the International Organization for Migration, that more than 3,000 migrants have already died in 2016 attempting to cross into Europe over the Mediterranean Sea. While Germany resettled nearly a million people in 2015, other EU nations have been far more reluctant. Since last year, the European public has resolutely told their national leaders to begin deportations and reform border security, often in urgently nationalistic language of the kind found in Brexit’s “Breaking Point” ad. The EU has begun to tighten entry for those immigrating from outside of the continent, and securing the southern border has become an existential test of whether the political federation can survive. Mediterranean countries are on the frontline of this effort despite their limited economic resources compared to their wealthier Northern neighbors. They have been tasked with the role of sentry, patrolling the walls of fortress Europe. Yet a backdoor to the castle seems to have been left open.

Since the 2008 financial crisis, many Mediterranean countries have begun to offer citizenship-for-sale to non-European nationals. These countries include places hit hard by austerity like Cyprus, Portugal, and Spain (where the program is called “golden visa” in a nod to the optimism about the value of an EU passport as well as excitement for the wealth that citizenship investors could potentially bring). Often connected to the purchasing of property, these programs offer residency, a passport, and—after several years—full citizenship to those able to pay several hundred thousand euros. Selling citizenship is a contentious idea that disrupts some of our basic notions about what it means to belong to a national community. Mediterranean states support it partly as a way to raise revenues after the global financial crisis, which brought budget slashing and pushed unemployment over 20 percent in many countries.

Since 2014, the tiny Mediterranean island nation of Malta has started to market its passports to the wider world. A former British colony, where English is an official language, and a current EU and euro currency member, it has much to offer newcomers looking for a cosmopolitan home and a base camp to access the rest of the European Union. While Malta has less than half a million residents, it is a member of the EU Schengen Zone, so participants in the Individual Investment Programme (IIP) have the right to live and work in any of the other 27 EU countries after an initial residency of one year is completed. The program is not cheap: the base cost is 650,000 euros on top of another 150,000 euros to be kept in state bonds, plus the price of purchasing or renting a home. These figures are both an estimate of global demand and a means to mollify concerned Maltese citizens that newcomers will be truly high-net-worth individuals from Russia, China, and the Middle East. This so-called citizenship-by-investment program enjoys significant support as a means to shore up the state coffers in uncertain times. It also stands in stark contrast to the generally negative reception of African migrants and Syrian refugees in Malta, who are routinely plucked off rafts in Maltese waters and deported or sent to detainment camps in the island’s interior.

The selling of citizenship disrupts our basic notions about what it means to belong to a national community.

Malta’s capital, Valletta, is a gem of both the decadent architecture of the Italian renaissance and a more indigenous style, jammed full of cantilevered wood balconies that seem to take inspiration from the island’s Middle Eastern historical connection as a deeply religious outpost of the crusading Knights of St. John. Yet most buyers of new Maltese passports will not be living in the densely-populated urban core of Valletta; instead they will be contained within new luxury developments that are being constructed at a furious pace in Special Designated Areas, essentially foreign enclaves. A lot of the zones look like posh Miami high rises with sea views, malls, and yacht ports. Many Maltese citizens think assigning new residents to special zones is a good thing, not least because it means local buyers don’t have to compete with wealthier foreigners, but it belies the claim that passport buyers will be integrating into the local society. Some of the several thousand enrolled in the cash-for-citizenship program forego buying for renting, fulfilling their obligation by spending 16,000 euros on an apartment each year for five years. One real estate agent ruefully described this loophole as an example of the program’s misrepresentation of investors’ actual assets: “Some people come here wanting to spend the bare minimum, even though they are supposed to be high income.” Indeed, given the EU’s free health care and subsidized higher education, buying a Maltese passport is a means to buy into a welfare state for one’s offspring, an alluring prospect for those who are wealthy but not mega rich.

Malta’s campaign to attract wealthy elites follows a strategy imported not so much from struggling countries with pressing fiscal problems as from up-and-coming city states like Singapore, Monaco, and Andorra. Citizenship is one perk along with deregulated finance, a growing gaming industry, and a thriving tourism culture. While Malta’s current citizenship program is capped at just under 2,000 applicants, the state can reopen it at any time it needs new revenue. This strategy has been used in Canada, where a popular program that attracted scores of Chinese residents had been opened and closed as needed before it was terminated permanently two years ago. Boosters of citizenship-by-investment often describe it as a sign of Malta’s open-mindedness when it comes to cultivating a multiethnic citizenry. Yet Malta’s bid to attract wealthy migrants has much in common with changes in the United Kingdom, where new laws require immigrants to make a minimum income in order to stay in the country. The ability to choose Malta’s future demographic composition is a delicate balancing act between appeasing less-wealthy Maltese locals by paying for new public services while creating zones of the island that are semi-gated, filled with Louis Vuitton stores and high-end steakhouses. New forms of citizenship are often about the segmentation and regulation of urban space.

In Southern Europe, citizenship-by-investment programs are intrinsically tied to property markets that were badly hurt by the 2008 crisis. The bursting of Spain’s real estate bubble left millions of empty homes, plummeting values, and entire ghost cities of half-finished villas. After such bad press, Mediterranean countries have struggled to lure back second homeowners who were essential to the economy (almost 20 percent of the housing stock in Mediterranean Europe is second homes, compared to just 3 percent in Northern Europe). In all of these markets, property developers have been frightened by the growing polarization between Northern and Southern Europe and have urged national governments to respond by courting global elites in place of traditional buyers from Germany, the Netherlands, and Scandinavia. The Brexit vote has only exacerbated this trend by taking UK buyers off the market and complicating the residency status of current British homeowners. Despite the challenges, some in the real estate industry are excited by citizenship-by-investment. Before 2008, they felt that EU-based property markets limited their business to merely well-off European clients; the innovation of citizenship-by-investment allows them to go after the truly global elites.

Those with a crisp new Maltese passport will probably not be getting to know the island very well. Initial residency is easy to fudge. After the wait period is over, newly Maltese citizens can work in Stockholm, enroll their children in heavily subsidized Dutch universities, or use Germany’s universal healthcare system. The selling of citizenship appears to many as a Southern European scheme to profit from the employment opportunities and stability of their Northern neighbors by selling access to stronger job markets and welfare states through their own immigration ministries. Michael Briguglio, a professor at the University of Malta and a former Green Party local councilor, called the country a “hub,” adding that the IIP is meant to attract “certain business people from China, Russia, and certain Arab countries to give them an open door to Europe. It’s a global form of patronage.” This issue is particularly sensitive in Malta, which is intensely Catholic; divorce was legalized only in 2011, and natives have a long history of viewing their island as a Christian entrepôt amidst Muslim trade routes. While the IIP vets criminal records and financial holdings, there seems to be little fear that citizenship-buyers will pose a safety threat. The pressing European worry of radicalization thus seems to apply only to poor migrants, ignoring a long history of economically comfortable and cosmopolitan participants in terrorist organizations.

For small countries, using passports as an asset to be exchanged for cash seems reasonable given a dearth of economic options.

As Southern Europe continues to have tense relations with wealthier EU nations over austerity, many politicians have been forced to cast a wider net to find allies and investors. Cyprus has drawn a large Russian population. China has invested in infrastructure and real estate in Greece and Spain. Portugal even saw the acquisition of a large national bank by its former colony, Angola. Compared to privatizing national industries or providing staging grounds for non-EU companies, selling passports is easy because it is geared toward mobility. It also reinforces the logic that small countries must constantly innovate in order to stay relevant to business opportunities and protect themselves from economic hardship. As Lino Bianco, a Maltese professor and the ambassador to Bulgaria, put it: “Maltese are survivors by circumstances. They turn failures into successes.” Using passports as an asset to be exchanged for cash seems reasonable given a dearth of economic options and a long history of trading, migration, and outside rule by regional powers. Unlike in larger countries, Maltese citizenship has always been negotiable and responsive to wider power struggles on the European continent. The most important thing for the Maltese was to get the best deal possible.

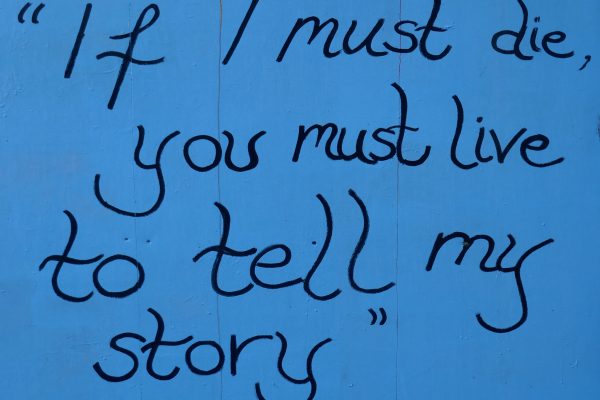

What differentiates citizenship-investors from those who go through a naturalization process is sweat equity. Citizenship-for-sale programs cynically reject the notion of national community, even at a time of rising xenophobia in Europe. Investors can experience citizenship—and all its attendant bonds, prejudices, and heart-stirring emotions—through a bank transfer and a paper booklet while the vast majority of those struggling to migrate must cross deserts, pack into dinghies, live in the shadows, struggle to maintain hope in detention centers, face deportation, study languages and history, and maybe, just maybe—only after many years—stand proudly among their friends and families with their hand on their heart.